Emerging Nepal Limited IPO Result: Hey guys, welcome to the Emerging Nepal Limited IPO Result blog. Here we will be providing you with all the latest news and updates of the Emerging Nepal Limited IPO Result. It has been a long wait for all of us, but we hope it is worth it.

Emerging Nepal Limited is going to launch an initial public offering on 26 Magh 2078. Emerging Nepal is an Investment organization in Nepal. The IPO opens on 26 Magh 2078 and closes on 30 Magh 2078. You can read the full offer document here.

How much did Emerging Nepal Limited sell shares for?

Emerging Nepal Limited IPO Result. The offer price was set at Rs. 215 per share and the company managed to sell 50,000 equity shares. The company is looking to raise a total of Rs. 10.75 crore from the IPO.

When will Emerging Nepal Limited’s shares be available for trading?

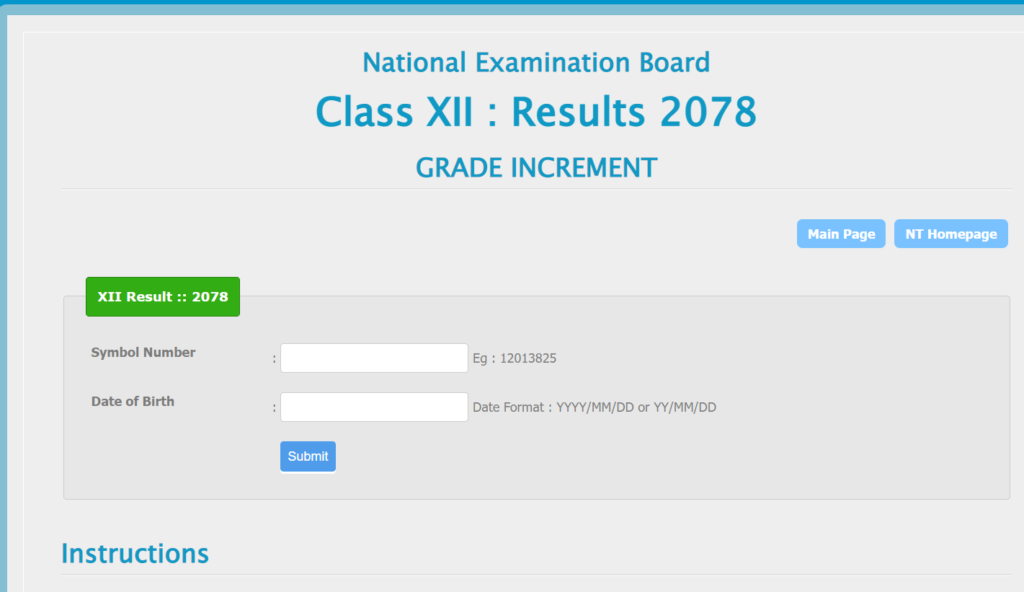

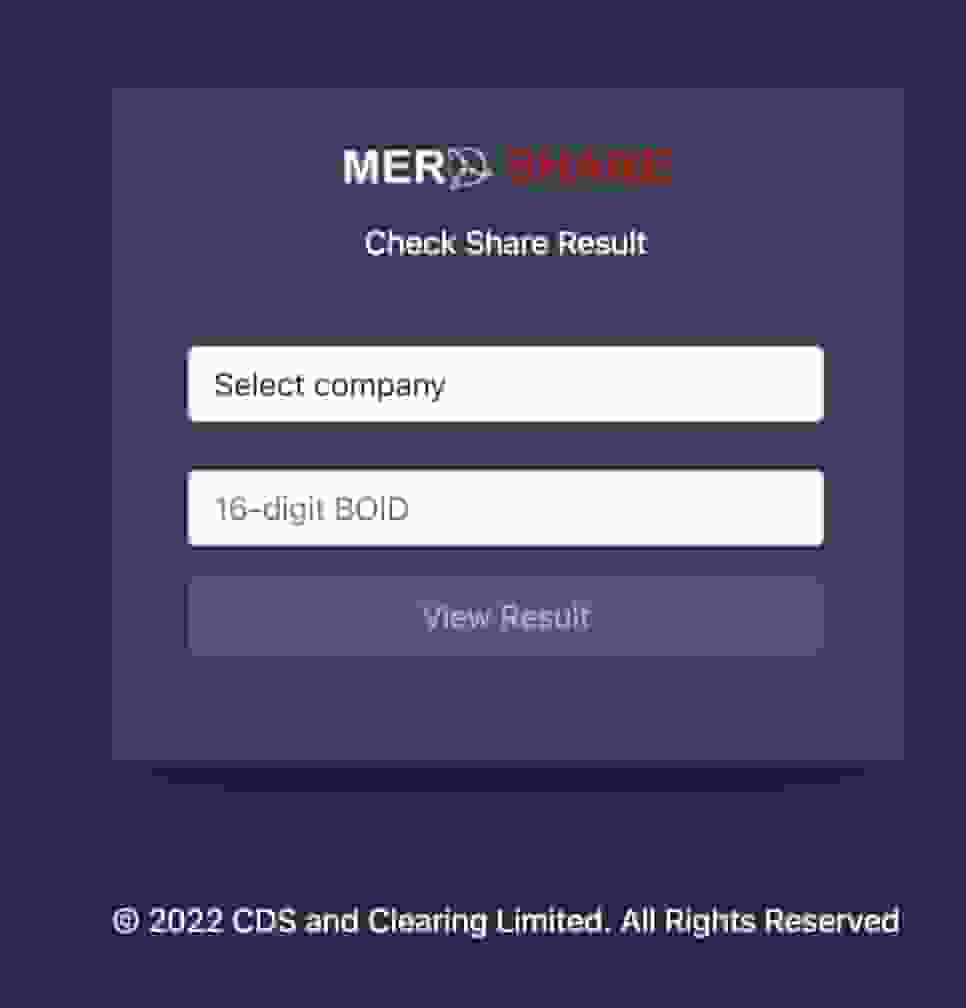

The Emerging Nepal Limited IPO Result is now available. The final price for the IPO was NPR 2,500 per share, and the company has set a target to raise NPR 1.5 billion. The shares will be available for trading on the Nepal Stock Exchange from September 4, 2018.

What are the factors that influence the Emerging Nepal Limited IPO price?

The Emerging Nepal Limited IPO price is greatly influenced by a number of factors. The first is the company’s financial performance. If it has been profitable and has a healthy balance sheet, this will reflect positively in the IPO price. The management team’s experience and track record is also key consideration.

Investors will want to know that the team is capable of running the company effectively and maximizing profits. The current market conditions and overall investor sentiment also have an impact on the Emerging Nepal Limited IPO price. If the market is bullish, the price will be higher, and vice versa.

When does Emerging Nepal Limited Fund Offer End?

The Emerging Nepal Limited IPO Result fund offer is open until December 14, 2018. The minimum subscription amount is Nepalese Rs. 20,000 (approximately USD $183) and the maximum subscription amount is Nepalese Rs. 200,000 (approximately USD $1,826). So, there’s still time to invest if you’re interested!

What are your Investment options in Emerging Nepal Limited after the offer is completed?

After the Emerging Nepal Limited IPO offer is completed, you have a few investment options. The first option is to sell your shares immediately after the IPO. The second option is to hold on to your shares and receive annual dividends. The third option is to sell your shares at a later time when the price is higher. Whichever option you choose, it’s important to do your research and understand the risks and benefits involved.

Conclusion of Emerging Nepal Limited IPO Resul

Emerging Nepal Limited IPO is a welcome addition to the Nepalese capital market, with many companies opting for Initial Public Offering. As you invest in Emerging Nepal Limited shares, it will provide you tremendous profits in future. The potential of Emerging Nepal Limited IPO’s returns is enormous!